RESOURCES | PLAYBOOK

HoT investment into spin-out playbook

This playbook provides a guide to the key points in the Heads of Terms (HoT) negotiation stage of spin-out commercialisation where there is a first institutional investor. It assumes that all relevant stakeholders have agreed on the decision to form a new spin-out company. A similar playbook for spin-out HoT with no investment or early Angel investment can be found here.

Section 1 - Introduction & Context

‘Heads of Terms’:

- Is a key stage in spin-out negotiation and formation;

- It covers a comprehensive set of critical rights, responsibilities and obligations on all (spin-out) stakeholders, especially the (spin-out) Company and the Founders; and

- Once completed, sets key agreed terms for the spin-out pack (suite of ‘downstream’ legal agreements). It is standard that the HoTs are non-legally binding, apart from any confidentiality provisions, but parties should intend to comply with the content agreed at this stage.

This playbook covers the spin-out (Investment) HoT and it should be noted that a separate, but aligned, Licence HoT (and template HoT can be downloaded from the resources page of the website), will be under development and negotiation, with the aim of concluding both these summary terms documents at the same time.

In many cases, the lead investor for a planned spin-out will have their own term sheet. However, the Deal Readiness Toolkit HoT for Investment template has been developed with input from venture capitalists, University advisers, and law firms. We therefore encourage you to adopt the provisions from this Toolkit when progressing your deals, as it is designed to align the interests of all parties in a University spin-out context. All the SETsquared Universities have endorsed the Toolkit, making it a strong starting point for negotiations.

Section 2 - Context for Heads of Terms

The negotiation of the HoT is a critical part of the overall spin-out Pathway and consolidates all previous activities, stakeholder discussions and early negotiations into a standard, consolidated package that covers all the important components of a spin-out investment transaction. If parties can complete all the sections of the HoT template, then, they should feel confident that the overall process can move onto the spin-out legal pack agreements final negotiations.

The spin-out Investment HoT covers the relevant key terms required for the spin-out legal agreements required, which are:

I. IP Licence Agreement

This document is the legal contract that grants the Company rights to use, develop and commercialise intellectual property originating from the University and this has its own separate Licence HOTs document.

II. Spin-out Articles of Association

This document is a key constitutional document (and subject to public disclosure) that sets out the rules for how the Company is run, governed and owned. The Articles form a contract between the Company and its shareholders, and among the shareholders themselves and is a public document. The Articles are distinct from the Shareholders’ Agreement and the focus of the Articles is to provide a legal framework for the Company’s operation.

III. Subscription Agreement

This document is a legal contract between the Company and the investors under which the investors agree to subscribe for (i.e. purchase) new shares in the Company, typically as part of a funding round.

IV. Shareholders’ Agreement

This document is a private contract between a Company and its shareholders that governs the rights and obligations of the parties and how the Company is managed. The shareholders’ agreement is distinct from the Articles and the focus of the shareholders’ agreement is to set out the commercial relationship and protections that are too detailed or sensitive for public disclosure; and

V. Company Business Plan

This document outlines the Company’s goals and strategy for achieving them. It serves as a roadmap for the business and is used to attract investors and will form a key part of the pitch documentation to investors.

A further description of these documents is included at Schedule 1. Schedule 2 covers a detailed description of how these agreements and documents fit together as a suite.

What this Guide Covers: [The ‘Anatomy’ of the Heads of Terms Template]

This guide describes the sections of the spin-out Investment Heads of Terms, which can be downloaded from the resources page of the website.

Section 3 - Parties to the Heads of Terms (List of the Stakeholders)

The first section of the template identifies who is involved (i.e. which legal parties) in the HoT. It’s usually expected that significant commitment is being made by the prospective lead investor at this stage with an approval in principle from its investment committee. Alternatively if initial investment is planned to be an angel round, then the lead angel would play that role; where the use of a well-developed template HOT would be especially advantageous. The University and Founders (latter would be identified individually) represent the key parties who are making various major contributions to launching the spin-out. It is expected that the Company (i.e. the planned spin-out) should be a legal party to the HoT. If the Company isn’t incorporated at this stage, then Founders should discuss with the investors and the University whether this is a requirement to move forward with the HoT.

The parties that are usually involved are:

- University (as represented by TTOs)

- Founders (each of them individually)

- Investors

- The ‘Company’ (the separate legal entity postincorporation, occasionally in this document linked to the Founders, representing the ‘Company’ at the pre-incorporation stage;

Key elements of the importance of each party are summarised below, and the role of Non-Founding Academic IP Originators is also covered.

3.1 University (as represented by TTO)

The University has a very significant interest in all aspects of the spin-out deal, since it is a founding institution, committing key resources, and licensing the core intellectual property. The Company may well initially be working within University premises and/or laboratories, and University staff (current or former) critical to the success of the spin-out may be involved in working in, or with, the company. The University is a significant shareholder due to its foundational role in supporting the research and innovation activities leading to spin out creation and, as such, has important shareholder rights and obligations, especially in the initial phase of Company development.

3.2 Academic Founders (‘Company’)

Academic Founders are even more critical for Company formation and successful spin-out launch and are involved in all elements of the spin-out, hence the deal and the HoT. Leading up to spin-out incorporation, they represent the future Company ‘concept’ and act on its behalf. Founders sit at the nexus of convincing the investor(s) to commit necessary funding to launch the spin-out and to take the licensed IP forward into a successful growing venture. Founders identify all necessary IP, people, resources and commitments where provisions will be required between University/Company. Academic Founders will need to complete their Conflicts of Interest Management Plan at the appropriate stage and it is recommended they seek independent legal advice.

3.3 Investors

Investors want to see the Company established and be able to meet commitments and attain milestones. To achieve this, they will require certain conditions in key parts of the overall spin-out deal package. While investors are not legal parties to all agreements e.g. the IP licence agreement, key requirements will be needed for successful commercialisation and venture stage building, so the HoT is an incredibly useful consolidating document that draws these essential features together.

3.4 Non-Founding Academic IP Originators;

A research team member who cannot, or does not wish to, have a role in the Company may still be rewarded through the issue of shares on Company launch. They will have a minor involvement in some arrangements, such as confirmatory assignments (usually called a Researcher IP Agreement). These confirmatory assignments underpin the assurances the University can give around the IP and are used to inform these individuals about confidentiality obligations, and what the licensed IP can, or cannot, be utilised for. Generally, the advice is that Non-Founding Academic IP Originator(s) should not be (a) party/ parties in the Heads of Terms.

The next section of the HoT template is the Background, which sets out the key principles and major components of the overall investment transaction, covering:

- Formation of a new Company;

- Investment from the Investors;

- Sets out the purpose of the business;

- Requirement to take a licence to key intellectual property; and

- Enter various other agreements.

Section 4 - The IP Licence Agreement (the ‘Licence’)

The IP Licence Agreement is an important part of the overall spin-out transaction. All the requirements of the licensed IP, and the commercial terms covering the grant of IP rights, should therefore be articulated in the IP Licence HoT (an agreement that is solely between the University and the Company). The HoT (Spin-out) then, will need to specify and reflect any licensing arrangements requirements from investors involved.

4.1 Stakeholder Summary Points for the IP Licence Agreement

The legal parties to the licence agreement will be the University (Licensor) and the Company ((spin-out) – or Licensee).

The key founding team have an important role in negotiation, but a conflict situation must be avoided. Therefore, the TTO staff must represent the University while Founders must act on behalf of the Company and must manage that conflict situation. The inclusion of any future management team representatives (e.g. externally recruited CEO) can play a role in such circumstances. Where a conflict may exist through the role of a TTO staff member acting as a Director in the Company (e.g. Non-Executive Director position), additional provisions to avoid a conflict of interest will be required by the TTO.

What IP the University includes in the IP Licence, including the University Improvements pipeline, is likely to impact the relevant research group. Therefore, TTO consultation with Founders’ department(s) is likely to be needed during HoT negotiations, to ensure the granting of IP rights is balanced and fair to all individuals.

Investors provide an input to the IP licensing requirements as they will have a view on the Company’s needs going forward throughout all potential venture stages.

Section 5 - The Investment Transaction – Initial Company “Set Up”

This part of the document outlines the key terms of an investment deal, specifically focusing on the initial setup of a Company and how it will be capitalised, with the investment mechanics detailed in a Subscription Agreement.

5.1. Shareholding

Shareholding: The fundamental consideration for the investor is the shareholding they gain as a result of making their investment into the Company. The ‘Capitalisation’ of the investment is described in the form of a share capital table (or commonly referred to as a “cap table”), and it is customary to outline the cap table position before and after the investment is made – for total clarity between the parties. The Company may wish to incorporate issuing a large number of shares, which can be more easily subdivided between the parties listed on the cap table in proportion to their equity stake. The Spin-Out Checklist document includes a recommendation on the process to follow for this stage. The cap table details in the HOTs Appendix the relevant groups’ shareholding levels at relevant stages of the spin-out process.

5.2. Share Incentive Plan

An important consideration for all shareholders is around the design of the Share Incentive Plan, covering an option pool to be created. A core principle is that such incentives are for the benefit of the overall Company and hence all shareholders should be diluted to the same extent by these plans. It is customary to include at this point (and display in the cap table) the creation of a share incentive plan (commonly referred to as an “options pool”). The options pool is used to incentivise employees and Founders at various stages of the Company’s lifecycle, by granting options (rights to future shares), which may increase in value as the Company grows and raises investment. The quantum of the options pool can be variable and is determined based on the specific Company needs; and generally guidance is that an option pool of 10% is appropriate and may be taken to a greater level with lead investor approval.

5.3. Company's Business Plan

The Company’s business plan may already state who is eligible for share options, as they are a critical tool to attract talent to the Company to bolster a salary by reducing the ‘hard cash’ cost of employees at the early stages. Incoming commercial management and other key talent hires should be the focus for share options, as part of their role in the spin-out and for hitting pre-agreed milestones. It is customary for these shares to ‘vest’ over a period of time, which provides the appropriate incentive for key personnel to not leave the spin-out too early.

5.4. Investment

Any investor receives shares in exchange for their investment in proportion of quantum invested, relative to an agreed share price, hence the of the company is critical to securing investment at a ‘fair’ price per share. <<A HOTs document simply expresses the subscription price to be paid and we have not explained pricing level methodology in these HOTs>>. An investor will typically scrutinise the Company’s business plan, in order to assess what the spin-out plans to use the investment proceeds for. This is a critical element of the Company’s business plan, and the Founders must raise enough funds to undertake key activities that subsequently increase the valuation of the Company in excess of the post-money valuation.

Setting a share price as part of the investment negotiations can be a contentious point between the parties (Academic Founders, Investor and to a lesser extent the University), as they are trying to maximise their own value in the spin-out. This share price (and therefore whole Company valuation) sets a precedent and will have huge impact on future investment rounds. It is wise to use comparator data to agree a share price and Company valuation ahead of an investment negotiation.

5.5. Pre-requisite conditions

Should the parties require any prerequisite conditions or ancillary agreements as part of the investment, the parties will need to mutually agree and expressly included these in the HOTs. (Further details are given below in section 3.5.)

Should the investors require certain warranties (factual statements to be made by the Founders or the spin-out), these statements must not be taken lightly, as if untrue then damages (often capped) are payable by the breaching party. The Founders and the Company will be able to qualify any warranty statements and further to that, should decide what to include in formal disclosure letters as necessary. Warranties provide investors with comfort about the state of the Company, the validity of the team and the commercial proposition, and also act as mechanism to incentivise those with the detailed, background knowledge (which is normally the Founders) to disclose material matters to investors.

If your investors require their investment to be made under the SEIS / EIS tax relief scheme, then they are likely to insist on Advance Assurance from HMRC. There are certain eligibility criteria, so the Company should ensure it is in scope and seek professional advice as appropriate. The investor may also require an Advance Assurance from HMRC that the investment will be (S)EIS qualifying before completing the investment. The timing for this will need to be factored into the completion timetable.

Section 6 - Post Investment Transaction

Rights of Shares (N·B: these are elements mainly covered in the Articles of Association, the key constitutional document, which will be publicly accessible)

As well as setting out the Company structure, the HoT provide an outline of what happens once the Company becomes a going concern. As well as the agreed business plan, it will set out the rules of shares, share creation, transfer of shares and what happens to shares when people leave the Company. It will also cover what happens if the Company is being sold.

When the Company is initially formed and launched, it will be prepared for the future. Most spin-outs should expect to have significant pre-revenue periods (prior to the Company being able to break even). These periods will often require several rounds of external investments (to fund significant development requirements), where new investors will almost certainly be required.

The ‘Rights of Shares’ are often described in detail in the HoTs to make sure all parties are aware of the initial agreed position. At company formation, all shares will normally be Ordinary Shares. However, this might not always be the case, where investors may require a different class of shares that give them certain preferences over the Ordinary Shares. Any alternative share classes included at incorporation should be considered very carefully and may have a significant effect in securing future investment(s). Where investors are seeking (S)EIS relief, the rights attaching to shares will need to be checked carefully to ensure that they are (S)EIS compliant, the USIT Guide (section 3.2.2 “Share Type” has an excellent description of ordinary and preference shares).

This section of the HoTs may set out the voting rights relating to the shares. It will also cover the rules relating to the issue of new shares and what share transfers are permitted and by which party.

However, as the Company grows it is often the case that new investment will be required, and this is likely to require further iterations of HoT, and terms will be driven by the new investors coming into the Company. The template provided can be modified to fit these needs, but certain parts of the document may need to become more complex, especially those that deal with the share class, new issuing of shares, and the like.

6.1 Pre-emption rights

For University spin-outs, just as with many early-stage start-up companies, several rounds of investments will be likely and suitable mechanisms need to be thought through for dealing with different entities being involved at the different stages. Normally, any new shares in private companies would be expected to be offered to all Ordinary shareholders pro rata. Pre-emption rights, also known as rights of first refusal, give existing shareholders the opportunity to purchase any newly issued shares pro rata. Universities usually do not invest in their own spin-outs at all and Founders are in a similar position, so we generally need specific waivers or carve outs around how to deal with the pre-emption rights of shareholders. Institutional shareholders (VCs) are usually the shareholders who wish to retain the right to avoid dilution of their shareholding.

Under the section on Permitted Transfers investors will normally seek rights to transfer shares and rights between their fund structures, including nominee accounts, and other shareholders (e.g. Academic Founders), similarly, they could transfer to family members and, in the case of Universities, they are likely to want to be able to transfer to an appropriate commercial subsidiary for shareholding purposes.

6.2 Compulsory Transfers of shares

This section of the HoT will also cover an important element relating to the provisions around Compulsory Transfers of shares, particularly for “Leavers”. A Leaver is a Founder who has a service contract (e.g. service, employment or consultancy contracts) with the Company, who leaves the Company before the end of the agreed contract. Here, we use the period of 3 years, which also includes a 12-month cliff period. The mechanism around Leavers’ Shares is standard in early-stage companies where the Founders are critical to the future success of the business. The Good Leaver and Bad Leaver mechanisms used are effectively an incentive (avoiding the disincentive of ‘Leaving’ – especially as a Bad Leaver) for Founder shareholders to remain committed to the Company for their share vesting period.

I. Leavers

Are classed as Bad Leavers, which will typically be for gross misconduct or fraudulent activity and hence Bad Leavers must lose their shares, where they are converted to Deferred Shares; or Good Leavers, where the quantity of shares that are lost will depend on time completed since the previous investment, and the vesting rules initially set out in the Articles of Association or Shareholders Agreements. Obviously, Founders should look to seek independent advice if appropriate as this is a significant matter where Founders’ and the Company’s rights are not perfectly aligned. Therefore, the wording of these clauses are potentially very important to the Founders, especially if share vesting is time bounded. Importantly, generally (and not just for University spin-out companies) it is usually the case that the (Company) Board can determine, at its discretion, that an individual who would normally be categorised a Bad Leaver can be deemed to be a Good Leaver.

II. Drag or Tag Along rights

Are a further important element of the HoT. These clauses manage what happens to shares in a potential sale of the majority of shares in the Company. These terms are usually defined in the Articles of Association. The Drag Along rights allow a specified majority of shareholders to force the sale of the Company. In these template HoTs, the required percentage of shareholders is suggested as 75% but certain cases may vary from this figure to some degree dependent on the Shareholders’ Agreement. These terms are needed to prevent a minority of shareholders from blocking a sale of the Company for the majority.

The Tag Along rights are designed to protect the minority shareholders, giving them the opportunity to sell their shares under the same conditions and price as the majority shareholders. However, the minority shareholders could decide not to exercise their tag along rights and retain their shares.

6.3 Key Stakeholder aspect

The ‘Rights of Shares’ section of the HoTs are clearly important for all parties, and do need to be understood by the Founders, as certain actions by the Founders could create costly mistakes. Probably the most important sections relate to Bad and Good Leaver provisions, as leaving will affect share ownership and any value contained.

For the University, as new classes of shares are created, the University needs to be aware of the preferences that are also created. The University share will always be diluted, but the University needs to be aware of the consequences, bearing in mind that it cannot follow-on with its own money, (if that is the case) in future rounds.

Section 7 - Specific Additional Rights in the ‘Shareholders’ Agreement’

A shareholders' agreement is a legal contract that sets out the rights and responsibilities of the shareholders and the Company. Its primary purpose is to govern the relationship, rights and responsibilities between shareholders and the Company by clearly defining key areas such as: the procedure for appointing directors, the rights of each party (including information rights), and protection for minority shareholders.

7.1. Appointment of the Board of Directors

It will be important for the University and the Investor to have a right to appoint a director or at least an observer to represent their interests, for as long as their shareholding remains above a certain threshold (e.g. 5-10%). The HOTs are likely to identify who will be directors at early stages and how many directors are required for a meeting of the Board to be quorate.

7.2. Decision-making

The shareholders agreement will include a section about decision-making in the Company. The material decisions will require Board approval. Investor will want to ensure that they have some say in the major decisions affecting the Company’s business and the value of their investment. The University, for example, may want to have a say in the Company changing in a material way the nature of its business. The HOTs will include the full list of matters requiring the special consent of the investors and/or the University. This list is an important insight for Founders to realise how Company management to needs to operate in the future.

7.3. Right to information about the Company

It is standard practice to include provisions that entitle each shareholder to receive management information, such as management accounts, the business plan, annual accounts. The company should be sharing these documents with investor and the University.

7.4. Non-compete obligations

You will also come across non-compete clauses in the Shareholders’ Agreement that will apply to academic shareholders. The University may well wish to appropriately resist such provisions to maintain academic research freedom, but this is a balance, of course, to be sensibly managed as both the individual concerned and employing institution are receiving potential commercial gain. The Universities are large organisations where research conducted in one area could potentially compete with the Company. The University must preserve its freedom to pursue such research activities. Key factors to be considered are:

- it can only cover the specific individual and not impact on other staff who are not involved in the spin-out,

- general versus specific restriction(s), where too broad a restriction/ exclusion would be concerning from an anti-competitive perspective, but (say) identifying specific direct companies may be more appropriate and

- the duration of any restriction.

While personal non-compete obligations for Academic Founders are ultimately their individual decision, with a recommendation they should receive independent legal advice, any such obligations should not restrict the University’s ongoing or future research activities involving those academics, particularly if they continue to be employed by or engaged with the University. Here TTO staff need to ensure that departmental management are well briefed on any research restrictions.

Section 8 - Ancillary documents and commitments relevant to Heads of Terms

Supplementary documents are likely to be referenced in a HOTs by providing more specific details, clarifying aspects of the transaction, and ensuring the proper execution of the main agreement. Investment will, however, invariably be conditional upon a series of agreements and contracts that may include exclusivity agreements, consultancy agreements, confidentiality agreements, due diligence requests, and more, depending on the nature of the transaction. Each spin-out with investment will, by the very nature of different investors, involve a variation on requirements, with the following being the most required:

- A Licence Agreement being duly entered into between the Company and the University (for instance, for a particular application, a market segment or even the rights exclusively granted to a particular licensee);

- Negotiation of definitive legal documentation, reflecting the HoT in detail and which will determine the legal relationship between the investors, other shareholders and the Company, in exchange for the funding. These supporting, or ancillary, documents to the Term Sheet pack serve as a “snapshot” of important legal and financial terms involving a proposed investment in the Company. All these documents are completed or executed around the same time as the investment transaction.

These legally binding agreements may include one or more of the following:

8.1. Facilities Access Agreements (FAA)

Outlining the terms and conditions for accessing a specific facility, whether it is a premises, laboratory, or other designated area. It is a contract between the facility owner (or a tenant operating the facility) and the access beneficiary, specifying the duration, type of access, services provided, charges, and other essential elements. These arrangements are commonly used as it enables the Company to access world-leading labs and equipment without having to make its own upfront investment, on the other hand, the University can receive a small level of external income to compensate for ‘sweating’ its assets.

8.2. Research Contracts

Formalise collaborations between Universities and external organisations for research purposes. They outline the rights, obligations, and responsibilities of all parties involved, including funding, intellectual property ownership, and data management. These contracts can be standard agreements, collaborator agreements, or bespoke agreements tailored to specific projects. Any Academic Founders involved in work at the interface between the two organisations will need to comply with their Conflicts of Interests Management Plan when planning for, negotiating and working under these contracts.

8.3. Consultancy Contracts

Formally define the terms of a consultant's engagement, providing a framework to support the broader terms of a deal. They outline the scope of work, payment terms, intellectual property ownership, and confidentiality obligations, ensuring clarity and protecting both parties involved.

8.4. Secondment Agreement

Outlines the terms of a temporary transfer of an employee from one organisation to another, usually for a specific project or period. It clarifies the secondee's employment status, including aspects like salary, benefits, and working conditions during the secondment and ensures a smooth and efficient transition for the employee, as it outlines the roles, responsibilities, and performance management process at the host organisation.

8.5. Obtain any clearance required under the National Security and Investment Act (NSIA)

The NSIA mandates that certain acquisitions or investments (such as in defence, cybersecurity, and critical infrastructure), be notified to the government for review. If an acquisition falls under this mandatory notification requirement, clearance must be obtained before the transaction can be completed. Once a notification is submitted, the government has 30 working days to review the acquisition and either clear it, call it in for a national security assessment, or decline to act.

8.6. Tax clearances

HoTs are not typically used to demonstrate tax clearance (a separate process with its own documentation requirements). However, HoTs can be used as supporting documentation in some cases, e.g. for regulatory filings or to potential funders. Whilst tax clearance is a separate process, the general idea is to provide evidence that any outstanding tax liabilities have been addressed. Documents can include:

- Tax Returns: Copies of filed tax returns, including income tax, VAT, and other relevant taxes.

- Tax Clearance Certificate: A formal certificate issued by the tax authority confirming that all tax obligations have been met.

- Payment Proof: Evidence of payments made to the tax authority, such as bank statements or receipts.

- Other Relevant Documentation: such as proof of registration, tax identification documents, or information about tax-related liabilities.

8.7. Investor Due Diligence (DD)

This often involves scrutiny of employment agreements, loan agreements, shareholder resolutions, and other related documents that may impact the deal. These documents help investors gain a more comprehensive understanding of the Company's operations, obligations and legal standing.

8.8. Investor (or shareholder) approvals

Primarily include resolutions approving the transaction, compliance certificates, and potentially agreements related to shareholder rights, like investor rights agreements. These documents are crucial for formalising the deal and ensuring compliance with corporate governance requirements.

8.9. Management questionnaires

Include supplementary documents that provide additional context, clarify details, or support the main agreement. These can range from board minutes and shareholder resolutions to more specific documents like loan agreements or retention agreements, depending on the transaction's nature.

Section 9 - Appendix – Capitalisation Tables

A capitalisation or cap table is a spreadsheet or table showing the ownership structure of the Company through equity. Cap tables should be updated to reflect each funding round and typically include:

- Equity Holders: Names or groups that own shares or options in the Company.

- Type of Ownership: Ordinary shares, preferred shares, or convertible securities.

- Percentage Ownership: The proportion of the Company owned by each party.

- Dilution Impact: How ownership percentages change after funding rounds or issuance of new shares

A cap table in the HoTs document is very likely to be the outputs of an excel spreadsheet, where all this information can be readily identified.

In the Template, three sequential tables are included to cover the incorporation and foundation stage, where all relevant individuals receive their shares and provides clarity that the distribution between Academic Founders, (any external Founders (if applicable) and Non-Founding Academic IP Originators is as intended (Table – Part 1). Then the impact of the University receiving its shareholding, prior to any external financing, is shown at Part 2. Finally, in Part 3, the post-investment completion allocation is shown, including the impact of the agreed level of option pool.

A more detailed description of the importance of equity levels for different stakeholders is covered in the “Spin-out Overview Playbook”.

Section 10 - Summary of Key Rights & Obligations

Stakeholder 1: The University TTO

The TTO serves a crucial intermediary and safeguarding role, ensuring the University’s intellectual property, financial equity, and research autonomy are properly negotiated, protected, and upheld during the spinout formation and investment process. The TTO will coordinate legal agreement drafting, conflict management, share structuring, and regulatory compliance, acting as the central point of coordination and negotiation on behalf of the University.

Technology Transfer Officer (TTO) Key Rights and Obligations:

10.1. Acts as the University’s representative in all stages of the spin-out negotiation process. There will be complex legal concepts that academics may not be used to. TTO helps to bridge the gap and can explain what is reasonable to expect or not. A strong collaborative environment between a University and the spin-out, can help it thrive into the future.

10.2. Must protect the University’s interests. Including its intellectual property (IP), equity, and governance rights in the new spin-out Company.

10.3. Must manage existing obligations or rights of third parties. Such as research funders or other external collaborators.

10.4. Manages IP licence agreement. And consults with internal University departments and research groups to ensure internal alignment.

10.5. Must identify and manage conflicts of interest. Particularly where University-employed Founders are also acting for the spin-out Company.

10.6. Ensures a clear division of roles. Between the University (as IP licensor) and the spin-out (as licensee and commercial entity).

10.7. Ensures the University’s position is maintained across all legal agreements.

10.8. TTO Ensure the University’s equity stake is accurately captured across all legal agreements.

10.9. Protects the University’s rights as a shareholder and secures board representation.

10.10. TTO must resist non-compete clauses. In shareholder agreements that would unduly restrict the University’s academic freedom or future research activities.

10.11. Ensure that obligations do not constrain operations. Obligations on individual academic Founders do not inadvertently constrain broader University operations.

10.12. Ensures compliance with regulatory obligations.

10.13. TTO oversees and coordinates execution of the required ancillary agreements.

10.14. Coordinates with investors and the Company. To provide relevant information and documents required during due diligence.

10.15. Ensures University contributions. E.g., IP, staff, and facilities are clearly documented and appropriately valued.

Stakeholder 2: Academic Founders (initially representing the 'Company')

Founders Key Rights and Obligations:

10.16. Getting into an entrepreneurial mindset. There is a culture shift that a Founder will need to be aware of which moves them more into commercial practice, which will feel different to what they may previously have experienced in academic collaboration. It is the responsibility of Founders to familiarise themselves with business, legal, tax and other commercial requirements when setting up a spinout company and writing up a business plan.

10.17. Driving the spin-out. Founders are central to the creation and success of the spin-out. They represent the Company pre-incorporation and lead negotiations with both investors and the University.

10.18. Must support due diligence processes. Provide info, sign off on warranties, and meet investor expectations.

10.19. Bridging Interests. They must balance University obligations, investor expectations, and the Company's commercial aims.

10.20. Conflicts of Interest. As many Founders are University employees, they must manage the actual or perceived conflict of interest from potentially having roles with both entities.

10.21. The Founders must have a good overview of the pack of legal documents. As obligations covered by warranties provided are set out in a number of documents.

10.22. Each key stakeholder will have differing priorities. AFs/s, University and investor/s will have differing priorities, there will need to be compromises for the investment to work for everyone.

Stakeholder 3: Investors

Investors Key Rights and Obligations:

10.23. Investors have the right to receive shares. In the spin-out Company, in return for their cash investment. Investors are obligated to provide agreed funding to the Company as set out in legal agreements.

10.24. Appoint a board director or observer. Investors typically have the right to appoint a board director or observer.

10.25. They have input in major decisions. Especially those affecting the business direction or financial value.

10.26. Entitled to track performance. Entitled to receive business plans, management accounts, and financial reports regularly to track performance and ensure transparency.

10.27. Investors may require warranties (binding factual assurances) from founders and the Company. Appropriate warranties on the intellectual property will be given by the University to the Company as part of the IP Licence Agreement, but not to investors themselves.

10.28. Request access to due diligence documents. They can request access to due diligence documents to validate the company’s legal and financial condition.

10.29. Their input is critical in shaping business milestones.

Stakeholder 4: Non-Founding Academic IP Originators

Non-Founding Academic IP Originators Key Rights and Obligations:

10.30. Typically researchers who contributed to the intellectual property. Non-Founding Academic IP Originators are typically researchers who contributed to the intellectual property (IP) behind the spin-out but do not take on an active role in the spin-out Company i.e. not a Founder. As a recognition they receive a shareholding reward for their contributions to the IP.

10.31. Sign Researcher IP Agreements. They must typically sign Researcher IP Agreements or similar, confirming that the IP they generated is properly assigned to the University, enabling the University to license the IP to the Company.

10.32. Obliged to contribute to the IP due diligence process. They are obliged to contribute to the IP due diligence process and must disclose any potential conflicts, especially if working on similar projects while employed at the University.

The Spin-out suite of legal documents is summarised below

1. Legal Document: Heads of Terms (HoT)

Parties: Founders, University, Investors, Spin-out Company

Non legally binding agreement. A document used to agree the commercial, and other key terms, ahead of creating the full legal pack of documents listed below. It will signal the content planned to be incorporated in the agreements, but is in summary, or plain English, form.

2. Legal Document: IP Licence Agreement

Parties: Spin-out Company & University

Agreement. The agreement granting the IP rights to the Spin-out Company from the University.

3. Legal Document: Articles of Association

Parties: Spin-out Company

Filing at Companies House. A public document that governs the running and management of the Spin-out Company. It sets out rights & obligations of Shareholders, including University, Founder(s) & Investor(s); covers powers of the Board; meetings; etc. Gives the Directors the powers to run the day-to-day activity of the Company and sets framework for decisions by Shareholders. Sets the structure of different share classes (if used). Will include terms about transfer of shares, take back/forfeit, in case of a leaver, and covers scenarios to enable shareholders to be involved in a sale of shares (tag) and/or be pulled along to force a sale of shares (drag).

4. Legal Document: Subscription Agreement

Parties: Spin-out Company & Investors

Agreement (could be Deed). Covers cash investment into the Company and shares that will be issued in return. Requires investors to accept and sign up to Shareholder Agreement.

5. Legal Document: Shareholder Agreement

Parties: Spin-out Company, All Shareholders (Uni, Founders, Investors, Non-Founding IP Originators etc.)

Agreement (could be Deed). Covering additional rights and responsibilities between the shareholders. This is not a public document, so is used to cover more commercial activities. Typically, also covers more detail on information sharing, restrictive covenants, warranties and may include decision rights that must be escalated to certain shareholders (if they hold over a certain %). It may set out how any revenue (dividends) is shared and if there are any preferential distribution of any sale proceeds to certain shareholders over others. May include certain provisions with respect to excluded sectors, ethics and decisions on approval of new investors.

6. Legal Document: Business Plan

Parties: Spin-out Company

This is the business case to investors. Sets the focus of the Company and how investment monies would be used and expectations on milestones to be achieved. The Shareholders’ Agreement will require Directors to manage the company in line with the Business Plan, otherwise the Directors will be in breach.

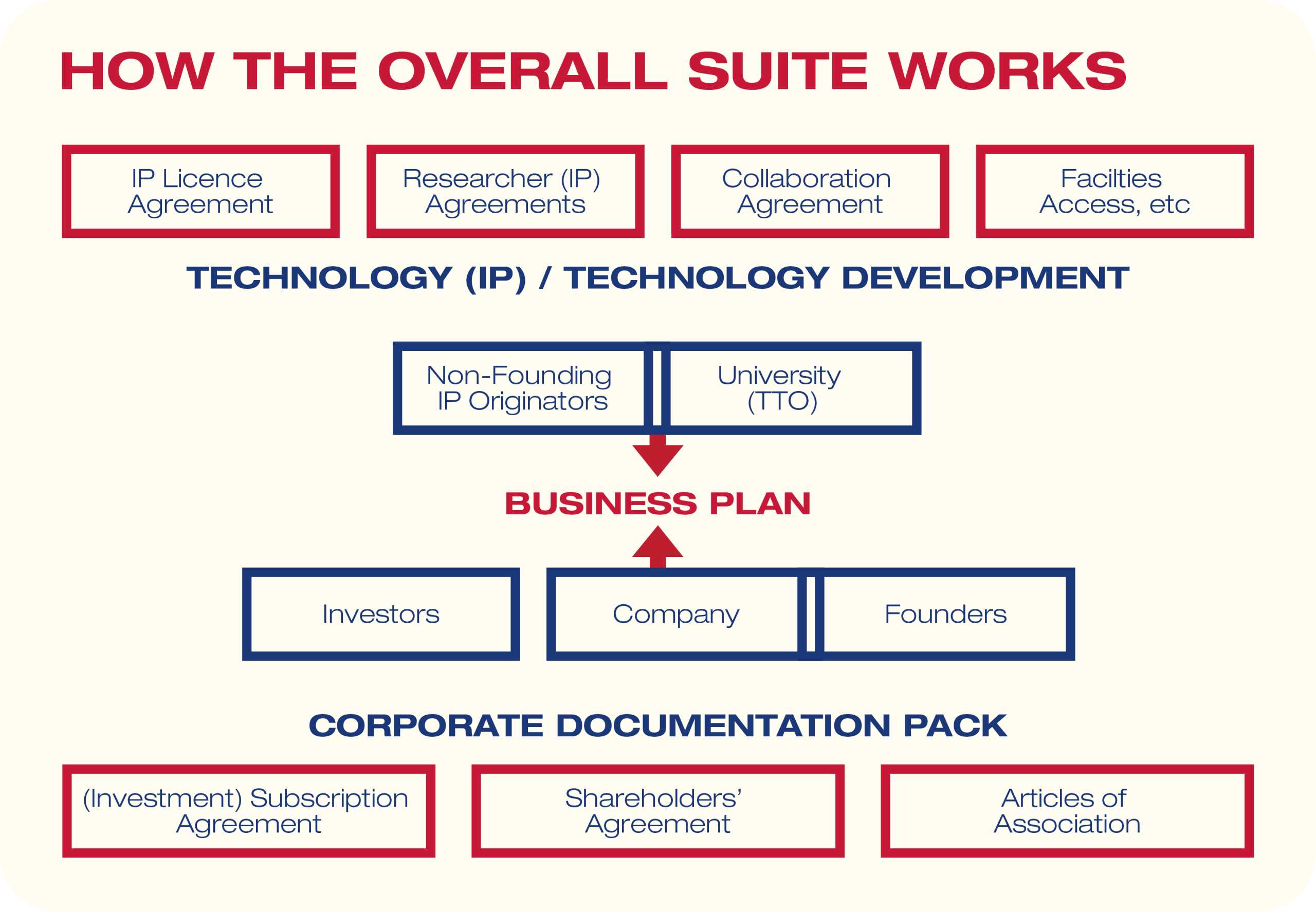

Section 11 - How the Overall Suite Works

The diagram below represents the relationship between the different agreements and documents and where relevant stakeholders are principally involved.

11.1. Suite of Agreements

In summary form, there are two main themes covering the spin-out suite of legal agreements. The first is for the corporate documentation (Shareholders’ Agreement, Subscription Agreement and Articles of Association). These will principally cover how the Company operates and is governed, particularly decision making and the specification of rights in shares in light of the aims of the investment transaction, planned future Company development and growth through successful commercialisation and ultimately, having the potential for shareholders to receive potential gain from equity ownership.

11.2. IP Licence Agreement

The second, the IP licence agreement, is the cornerstone of the additional elements of the spin-out suite. It provides the grant of rights in the IP from the University and the parties, with the intention of delivering suitable initial protection for the investment and other commitments made to the Company. Supplementing the licence agreement are consultancy / secondment or collaboration agreements to further develop the licensed IP, which can be put in place. Service agreements with Founders should provide the necessary commitment from key individuals who are needed for the future success of the spin-out.

As shown in the diagram above, all these elements and key groups involved are pulled together in the spin-out business plan.

Contents

Section 1 - Introduction & Context Section 2 - Context for Heads of Terms Section 3 - Parties to the Heads of Terms (List of the Stakeholders) Section 4 - The IP Licence Agreement (the ‘Licence’) Section 5 - The Investment Transaction – Initial Company “Set Up” Section 6 - Post Investment Transaction Section 7 - Specific Additional Rights in the ‘Shareholders’ Agreement’ Section 8 - Ancillary documents and commitments relevant to Heads of Terms Section 9 - Appendix – Capitalisation Tables Section 10 - Summary of Key Rights & Obligations Section 11 - How the Overall Suite WorksResources

Explore our ‘how-to’ guides and legal agreement resources to streamline spin-out company formation, help find investment and optimise licensing transactions.

PLAYBOOKS

How to guides explaining the ‘why’ and the ‘how’ of the commercial deal, ensuring an efficient process.

View PlaybooksTEMPLATES

A suite of lawyer-reviewed, legal Templates for everyone in the commercial deal to use.

View TemplatesCHECKLISTS

Useful Checklists to ensure that all critical elements are considered in the commercial deal.

View Checklist