RESOURCES | PLAYBOOK

Spinout Overview playbook

This playbook provides an overview of the key steps involved in forming a University spin-out, along with the context of why you may consider a spin-out vehicle in the first place. It’s intended to act as a guide to University staff who are either considering a future spin-out or, possibly, at the early stages of working towards creating one. It covers many important aspects of commercialising intellectual property (IP) via a dedicated, new company vehicle, but many other reference materials are also available – such as Knowledge Exchange UK guide (Layout 1)

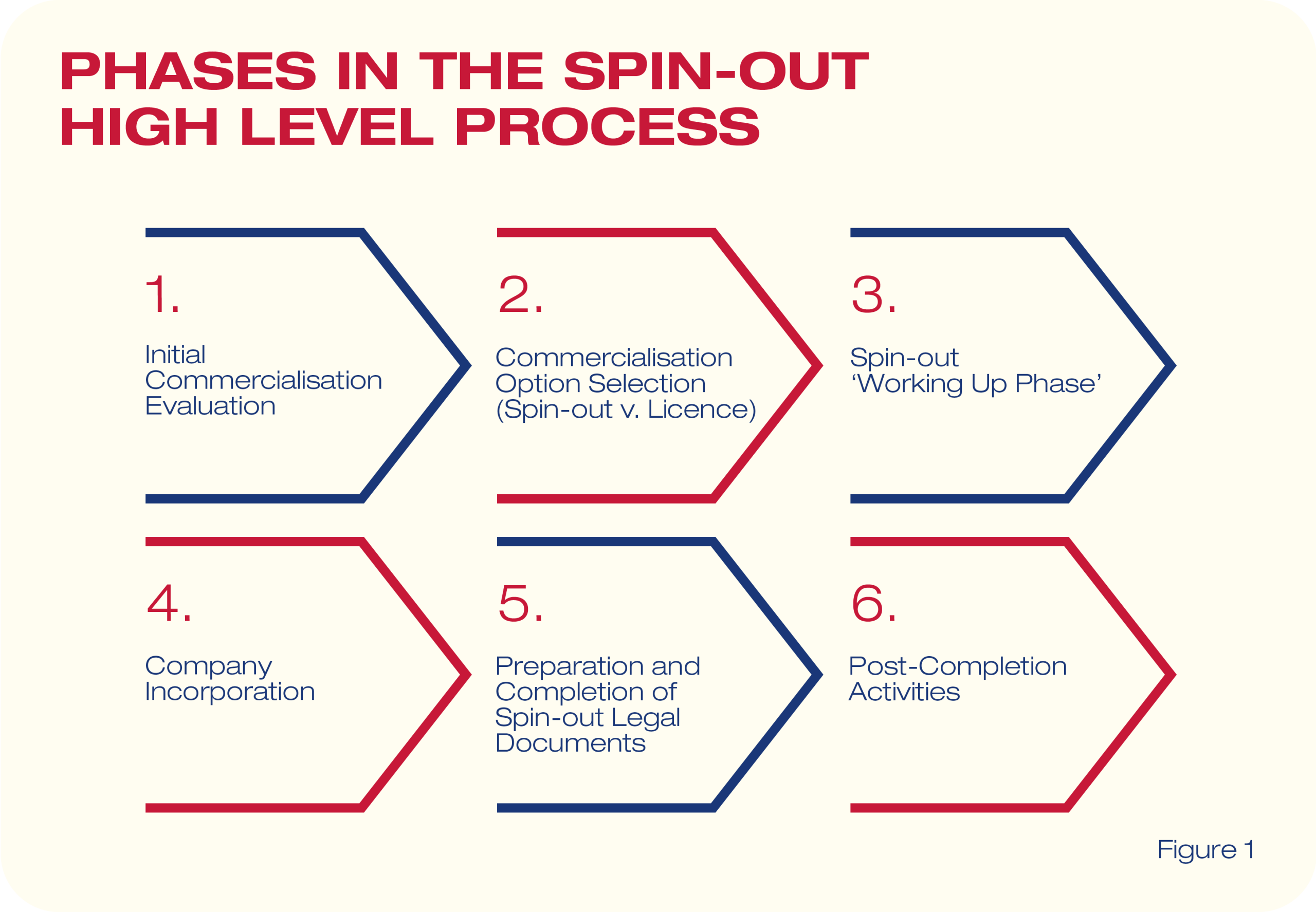

This playbook seeks to describe activities that are undertaken in a standard set of process steps. We will indicate instances where some variation in timing may arise in individual cases. In summary, the schematic below covers a sequence of activities that can be involved in creating and launching a University spin-out company:

Section 1 - Spin-out Context and When Spin-out is Appropriate

1.1 What Is a University Spin-out Company?

A University Spin-out Company is a company that is created as a result of a decision to commercialise (the relevant) intellectual property (IP) via a brand new (company) entity rather than licence to an existing company. In practice, just as in arm’s length licensing, there will be a formal licence of the IP from University to a licensee or the company, but the context and expectations for the licence agreement will differ in spin-out cases (see the next section). This is because the licensor (the University) will nearly always have an equity stake in the licensee and therefore is compensated both through licensing arrangements and in realisation of company equity value.

Comparison between spinout vs existing company licensing terms.

1. Key Terms: Payment for the licence

Spin-out: Usually in the form of equity – royalty is also commonly used after Independent Spin-out Review and many institutions revising their equity policy.Licence fee terms may be more flexible and long-term objective oriented to encourage growth.

Licence to an existing company: Percentage royalty or recurring payments likely to include Upfront or Initial Fees, along with milestone, minimum annual royalty, etc…

2.Key Terms: Technical assistance

Spin-out: If an inventor is taking a role in the spin-out, this will be provided as part of their agreement with the spin-out or University as appropriate

Licence to an existing company: For negotiation, but very unlikely to have long-term involvement unless a companion R&D collaboration agreement is used.

3. Key Terms: Time limited access rights to certain relevant IP improvements

Spin-out: Generally standard in spin-out IP licence deals.

Licence to an existing company: More unusual, but can be included over shorter periods and subject to other projects sponsorship in research group.

4. Key Terms: Recovery of past IP costs

Spin-out: Usually recovered once affordable e.g. attached to commercial milestones e.g. Fundraising.

Licence to an existing company: As with spin-out but usually less flexibility.

1.2 In Section 2, we describe in further detail

i) how the licence v spin-out strategic option decision will be made and

ii) what differences then take place when spin-out is the resulting outcome.

It is important that the researchers who are expected to form part of the founding team are briefed early on about how much hard work is involved in founding and running a company, and that they should consider their personal circumstances relating to how much time they can commit to the proposed spin-out.

Initially, there are several important early steps required when licensing to a spin-out or to an existing company. Hence, these are described as generic IP commercialisation steps.

1.3 Generic Commercialisation Steps

1.3.1 Completing IP Due Diligence

Prior to preparing for spin-out and incorporating the company, your Technology Transfer Office (TTO) will have begun IP due diligence (IPDD) to establish the IP ownership, inventors, contributors, third party involvement, permission requirements and potential barriers to commercialisation (or encumbrances). For more in-depth guidance on the process, see the IPDD Playbook and IPDD Checklist.

Before any commercialisation deal (including spin-out) can happen, the TTO will check the formal IPDD documentation has been completed. This includes:

- Percentage contributions of each inventor, contributor and originator to the relevant IP agreed (as part of a signed invention disclosure).

This is the starting point for informing financial compensation decisions through equity and/or royalty distribution (see Founding Share Capitalisation Table for more information). - Assignment of the IP to the University.

This confirms the existing contractual position for staff. For students involved in the creation of the IP, their rights will be assigned to the University in consideration for the agreed share of benefits via a confirmatory assignment. The University should have standard assignment agreements and these should be signed at the earliest opportunity and capture all the IP that is going to be licensed to the spinout. The spin-out will not be able to readily demonstrate chain of title to investors without these assignments. The terms of any funding agreements that relate to the IP to be assigned and licensed will need to be checked, this is carried out as part of the IP due diligence process.

As mentioned above, if third party institutions or funders are involved then further confirmation of rights, consents and/or revenue sharing terms will need to be planned, discussed and subsequently negotiated and confirmed by written agreement. This process will take time and so should begin as early as possible. However, it can be done in parallel with much of the spin-out preparation activity so as not to delay the spin-out process. Any research funder’s rights will typically need checking against the original funding agreement. Funding agreements may also highlight the need for the University to seek consent and negotiate revenue sharing terms with the identified funder. Where a third-party institution is involved an Inter-Institutional Agreement may be necessary, see the Inter-Institutional Agreement Playbook and Template.

1.3.2 Commercial Assessment

Institutions will have their own approaches to assessing the potential commercial opportunity of all disclosures that are submitted. Standard approaches should be used in all cases and, as a general rule of thumb, the disclosures indicating low or very marginal level of a market size are probably not suitable for further consideration as potential spin-out candidate. The possible exception to this would be for a minor market opportunity currently, but where very large future growth in this specific science or technology innovation were being forecast. In almost all cases, financial investors will be interested in technologies or innovations that have a large potential (or current) market and, in addition, have strong expectation of future sustained growth. Investors will typically look for ‘hot’ areas e.g. deeptech, AI, biopharmaceuticals, etc.

In the field of very early-stage science or technical innovations, there is a high level of uncertainty around future market size. Mainly because of this fact, in the UK, the Innovate UK agency supports the ICURe Market Discovery programme which supports researchers in establishing the commercial potential of their innovation. Most TTOs have some experience of working on ICURe projects - the scheme has been operating since 2014 and will have networks of commercial experts, consultants and investors who can be useful in supporting market and opportunity assessment If this is of interest, then you should discuss whether ICURe is appropriate for your project with your TTO. All new business ventures will be based on assumptions; a scheme such as ICURe helps to ensure that yours are reasonable and supportable.

1.3.3 Identifying Enthusiasm and Potential for Individuals and Key Roles

The founders must be fully engaged with the process. The founders should consider how much time they can commit to the new company, and how that fits in with their family and professional lives. Permission may need to be sought from the relevant faculty/department for researchers to spend time on commercialisation activities – University HR teams can advise. The researchers also need to be made aware that any new company will need commercial leadership. It is rare, but not unheard of for a researcher with no commercial experience to become the CEO initially. This is because investors expect to see experienced commercial managers running the organisation, and because researchers just will not have time to run the organisation as well as developing the offering (product, process, software, etc,). Overall, the most important requirement is that across a team, all the required expertise has been brought together, so a researcher working with a part-time experienced Chair may be appropriate for some spin-outs. More typically, academics/ researchers tend to have more significant input to CTO (Chief Technology Officer) or CSO (Chief Scientific Officer) roles or another advisory role in the new company.

Section 2 - “Spin-out” v. ‘Licensing’ – Why and How Decision is Made?

In deciding whether to consider the spin-out route versus licensing, the following factors (decision criteria) should feature in the early innovator- TTO staff discussions and early evaluation (final stages of Section 1):

- Above-average commercial opportunity (including potential growth);

- Lack of competition, including if existing established companies who target similar customers or end-users, identifying that but their technology or offering is at too early a stage of development for existing companies; and/ or

- Key members from the IP inventing/ creating team are highly motivated to play significant roles in supporting commercialisation of their innovation or technology via a spin out company,

- Considerable technology de-risking in a commercial environment is likely going to be needed to attract corporate partners (e.g. therapeutics).

More information on ‘Spin-out Pathway’ is included on our website here, to help guide decision-making on spinning-out versus licensing, including an informative video from the University of Manchester Innovation Factory.

The remainder of this guide provides an overview of the main steps when preparing to spin-out and launch a company.

2.1 The Difference: Spin-out vs. Licensing IP

In the remainder of this Section 2, we describe key spin-out requirements and preparation steps required, along with the need to establish University approval routes.

2.1.1 Spinning-out has many more dimensions than an arm’s lengthlicence deal

People – the team themselves – if people are going to be taking roles in a spin-out, then department/ Faculty discussions are required, permissions may be needed according to University policies, and conflicts of interest identified and managed;

People – the ‘reward’ distribution features – where, for:

- IP licence deal, the sharing of any potential rewards to inventors are relatively y simple, and are undertaken in accordance with the University’s IP regulations (policy) – this is purely on the basis of the proportionate contribution to IP created (& subsequently licensed).

- For spin-out, this can be very different. Where a spin-out company is created, usually, the relevant University will take a lower proportion of the founding equity (post Independent Spin-out Review and following USIT Guidelines). The spin-out Founders will distribute the remaining Founding equity (probably from 75% to 90%/ 95%) in the spin-out amongst themselves, where the main focus should be on working in, for or with the spin-out to build value over the long-term for the benefit of all shareholders. This means individuals having a major role in the future of the company should have a greater equity participation than someone else – who may remain in academia and only contribute as a past joint inventor on some of the licensed IP.

Building a completely new company – unlike an IP licensing deal, where the University allows an existing company to develop and commercialise resources and processes already in place, to licence the relevant intellectual property; in the case of a spin-out, the company begins with zero assets and other resources. An emerging business plan proposes plans to build a team, run essential operations and seek to realise certain milestone targets within the first years of operation. In some cases, operating from University laboratories and offices (or incubator space) can be the most cost effective and flexible way of building a spin-out company over the initial two to three years. In every cases, the team will need to discuss and agree in advance, with the relevant department and Faculty staff, to ensure any required facilities and space options can be supported and the contracting requirements are understood.

2.1.2 University Approvals Approach

In addition to the involvement in the spinout of key University staff, the potential use of university space and facilities also requires University agreement. The University Technology Transfer Office (TTO) will regularly update senior University staff on general progress of all spin-out portfolio planning, but spin-out founders should discuss with their TTO contact when to seek appropriate University approval and how to prepare for this.

Whilst individual university approval processes will differ, your TTO will advise on your own University’s requirements. These generally will need to cover both:

(i) approval, in principle, on standard terms, and

(ii) approval of any specific case variations from standard deal terms.

Universities may combine these components into a single form and meeting review. A staged approach, is more helpful for capacity management where a large level of activity is taking place. Section 3, the spin-out working-up phase, will cover University Approvals.

Section 3 - Spin-out Preparatory (or ‘Working-Up’) Phase

3.1 Introduction

This guide is intended to provide an overview of numerous inter-related goals, and the planning required to work towards them, in the development of an over-arching plan for creating a successful spin-out launch, leading to future successful commercialisation activity.

In common with general commercialisation projects, we start activities from an early stage of technology development and ‘readiness for commercialisation’ and we seek to complete certain key steps to become ‘ready to spin’. Typically, likely spin-out candidate opportunities need to evaluate their ‘technical maturity’, along with commercial/ market readiness. It’s likely that the reader already knows, or has heard, that a lot of work is involved in a University spin-out, and there’s no getting around the fact that is true for all stages of development. However, this preparatory phase of spin-out development tends to be when founders really comprehend the significant step change they are making in the significant resources and time spent taking the spin-out concept forward. By the end of this stage, the spin-out founders will be able to:

- Articulate a ‘value proposition’ around their innovation, that connects IP, team capability and a commercialisation plan with a clear market opportunity;

- Detail the importance of intellectual property (IP) they have generated, the IP strategy planned and how protection creates a sustainable advantage for the potential spin-out;

- Describe in simple terms how their innovation compares to the ‘competition’ and the probability of new alternative approaches emerging;

- Describe an operational plan for building a suitable team and all other required resources, including any specialist facilities and contractor or consultants, the funding required to deliver this;

- Outline a development plan indicating critical milestones, a programme of work to deliver this, the key risks involved and a plan for mitigating those future risks, and

- Formulate a financial plan over multiple years underpinning the above, that indicates key sensitivities to development plan risks.

Completing these elements of planning to launch a new start-up company will be necessary to convince all stakeholders, including founders themselves, that the main elements have been considered and factored into the overall plan. For anyone who hasn’t been involved in new start-up activity before, it may seem daunting at times. Some individuals may feel uncomfortable with the level of uncertainty around numerous key decisions. This feeling can’t be avoided and should be embraced.

In the following sections, the guide describes the phases of activity and the type of planning and summary information that founders will need to compile into the various materials used to plan the spin-out concept. By the time that those involved in working-up their opportunity have worked through the content of this section, they will have a clear understanding of how ready they are to achieving ‘spin-out’ status and what, if anything, else they need to finalise or do to become ready to complete all stages.

3.2 Business Plan

Business Viability

A business plan demonstrates that there is a viable and sustainable commercial opportunity. It is required at this stage to illustrate to the University (and usually investors and other shareholders), that the spin-out has a plan to reach commercial traction and sustainability. The business plan should include the spin-out’s vision and mission, the Company structure and operational plan, products and services, route to market, sales strategy, and financial model. Each University will have its own requirements for a business plan and can offer advice on document structure and/or provide a template.

The business plan may also identify that specific University resources are required for the spin-out to get up and running, especially in the early stages of becoming operational. This may include access arrangement to key University staff as well as any facilities or services. Any University space or equipment that the Company may want to use is to be discussed and terms negotiated and agreed with the relevant University managers. Examples include Facilities or Laboratory Access agreements which will include provisions for charging methodology, Company employee access rights and health & safety.

3.3 Management Team

The Founding Team

Understanding who will be involved in the spin-out company and how they will be involved is important for establishing roles, responsibilities and individuals’ relationships with the University and the company. Academics who join the spin-out company as employees or consultants are called “Academic Founders”. Inventors who have contributed to the invention but remain wholly at the University and do not take any role in the company are called “Originators”.

The Academic Founders and the University may also choose to recruit additional Founders to the spin-out company in executive or non-executive roles, to optimise the success of the Company, for example, bringing in an experienced, full-time CEO who has a track record of raising investment and launching products to market.

A list of Founders, their role in the spin-out and their split of time between University and spin-out company is required for:

- Ensuring that individuals have the correct permissions and agreements with the University and the spin-out company.

- Identifying IP Originators, who may receive shares in the spin-out or, in some cases, their shares can be held on their behalf by the University.

- Establishing future distribution of licence fees and royalties according to the University’s IP and revenue sharing policy.

- Creating the initial, pre-investment capitalisation table.

- Identifying how new IP created in the spin-out or University should be handled.

Academic Founders that continue employment at the University require permission from the University to join the spin-out company and will need to negotiate terms related to the share of time away from the University, whether as consultancy, secondment or part-time employment at the spin-out. They will also need to complete the notification of Conflicts of Interest in accordance with their University’s policy.

Dependent on the University’s IP policy, Academic Founders taking a shareholding in the spin-out company may not be allowed to receive further benefit from the spin-out via the University’s revenue sharing policy. This is because the founder would benefit twice over from the success of the company, both as a shareholder and again through the University’s revenue share. The researcher shareholder waiver is a legal document that waives the rights of a shareholding founder, to the University’s share of revenue. Each University has its own specific document which will be provided by the TTO.

Founding Share Capitalisation Table

A capitalisation or cap table is a spreadsheet or table showing the ownership structure of the company through equity. Cap tables are updated to reflect each funding round and typically includes:

- Equity Holders: Names or groups that own shares or options in the Company.

- Type of Ownership: Common stock, preferred stock, or convertible securities.

- Percentage Ownership: The proportion of the Company owned by each party.

- Dilution Impact: How ownership percentages change after funding rounds or issuance of new shares.

It is important that spin-out companies start thinking about their cap tables early and prior to incorporation. They are vital tools for managing the equity structure of a business, and function as a ledger that provides a clear and detailed breakdown of who owns what within the Company over time and as new investors come on board or equity-based compensation is granted. This includes founders, investors, employees with stock options, and any other stakeholders with an equity interest.

The Role of Capitalisation Tables in Technology Transfer

For technology transfer professionals, cap tables are more than just financial documents. They are strategic tools that influence decision-making and ensure the long-term success of University-based spin-outs and are relied upon to manage equity stakes, negotiate deals, and ensure that the University’s intellectual property (IP) is leveraged effectively to drive innovation and economic impact.

- Equity as a Key Asset: Universities often take equity in exchange for licensing IP to startups. The cap table is critical for understanding the value of that equity, tracking changes over time, and managing the University's stake as the startup evolves.

- Negotiating Funding and Ownership: During funding rounds, the TTO must evaluate how equity dilution affects the University's ownership and potential returns. The cap table provides a clear picture of post-funding ownership structures, helping to ensure fair and strategic agreements with investors.

- Transparency and Compliance: Universities are accountable to stakeholders, including faculty inventors and institutional boards. A well-maintained cap table ensures transparency in equity distribution, fostering trust and meeting reporting requirements.

- Strategic Decision-Making: Cap tables help TTOs to understand the proposed development, commercialisation and funding lifecycle of the future spin-out company . This information is crucial when deciding whether to provide additional support, participate in funding rounds, or renegotiate terms.

- Investor Relations: Cap tables are key in discussions with venture capitalists or angel investors, as they demonstrate the startup’s equity structure and potential for growth.

- Royalty and Revenue Sharing: A well-documented cap table aligns with revenue-sharing agreements, ensuring inventors and departments receive their fair share of returns.

Founders may also want to include an options pool when considering equity and the cap table; this refers to a portion of a Company's equity set aside for issuing stock options to employees, advisors, consultants, or other service providers. It's essentially a reserve of shares that can be used to incentivise potential new joiners and compensate these key individuals without diluting the existing shareholders more than necessary.

Things to consider when including an options pool in the cap table:

- Purpose: The primary purpose of an options pool is to attract and retain talent by offering them an opportunity to purchase shares in the Company at a later date, usually at a set price (the exercise price).

- Size: The size of the options pool is usually expressed as a percentage of the Company’s total shares outstanding (or fully diluted shares). Commonly, it can range anywhere from 10% to 20% of the Company’s equity.

- Impact on Cap Table: When options are exercised, new shares are issued from the options pool. This dilutes the ownership percentage of existing shareholders (including founders and investors) because the total number of outstanding shares increases. Therefore, it’s crucial for stakeholders to carefully manage the size of the options pool to balance equity dilution with the need to attract and retain talent.

- Adjustments: As the company grows and raises additional funding rounds, the options pool may need to be replenished or adjusted to maintain its effectiveness. This adjustment is often negotiated during subsequent financing rounds.

Cap tables should be developed by the Founders with support from their TTO It is key that individuals going forward in the Company are incentivised appropriately, whilst those remaining in academia take a lesser equity share. The TTO will be able to provide an example Cap table spreadsheet and most importantly, Founders will need to discuss detailed cap table information with prospective investors.

3.4 Investor Plan (Engagement/ Pitch Deck)

As the Founders continue to develop their commercial thinking around forming a new Company, then, one key area to concentrate on is engaging with venture investors and convincing one of more of them to provide any external funding that the business plan indicates is required. In addition to the business plan documentation being clear and precisely detailing the key elements of the business proposition in a convincing manner, the team will need to create an investor pitch deck. The pitch deck is a visual presentation (usually PowerPoint) that seeks to engage an investor audience with a compelling narrative around the business proposition. It needs to contain only sufficient information to be compelling, without overloading the listener with information. By contrast, the business plan needs to contain a greater level of information that provides assurance on many different facets such as what experiences and capabilities do key staff bring, what are all the key resources required to execute the plan, how will you achieve key goals including in the development plan, what sensitivities are important in your financial model, etc.

Many examples (templates) for pitch decks can be found, including online. For academic Founders who haven’t been involved in any previous start-up activity, general advice would be to seek support of mentors, who could be colleagues who have previously formed a spin-out, or find out if your University has Entrepreneurs-in-Residence in place, or seek out and start to work with incubator or business accelerator groups at your University or local business or science park.

3.5 Spin-out Incorporation Stage

If significant progress is being made towards spinning-out, then, making sure the Company vehicle is established is recommended. The steps involved in this are described in Section 4 and there isn’t a fixed, single point when incorporation has to take place, Founders, consulting with their TTO advisers, have some flexibility on the timing. However spin-out incorporation must happen prior to completion of the spin-out IP licence agreement being executed.

3.6 Spin-out Heads of Terms

Many of the steps above should be progressing in parallel and the various parties involved should consider planning for completing the spin-out Heads of Terms (and there is also a Licence Heads of Terms document aligned with this). The Heads of Terms is a summary document that covers the key elements of all the most important parts of the spin-out deal and how all shareholders work together into the future. All elements of the Heads of Terms need to be comprehensively covered before moving onto final deal negotiations and completion. The Heads of Terms activity may not be finalised before moving onto Section 4 (Incorporation) or beginning to commence Section 5 (Post Incorporation/ Finalising Preparation).

Outcomes:

- Good, robust working version of Business Plan created (noting that this will continue to be refined).

- Agreed plan of Spin-out Key Staff Involved; along with their roles; exact level of involvement (e.g. – 20 days consultancy, 20% or 40% FTE joint role – or moving 100% to Company not yet finalised – but known in broad terms).

- Good version of investor pitch deck being used and improved.

- Know exactly the plan of what dates your spin-out is going to relevant committee for seeking University approval (or may even have done first evaluation assessment).

- You may have already incorporated (as detailed at Section 4) the planned spin-out at this stage, or if not, this should be undertaken in line with the overall spinning-out plan.

- The Spin-out Heads of Terms may or may not be complete at this stage, if not, then this is continued at Section 5.

Section 4 - Legal Incorporation of the Spin-out

At an early stage in the spin-out process, the spin-out company will be incorporated. By incorporating a Company, you are creating a separate legal entity, that in the majority of cases affords you protection from personal liability and is the most suitable vehicle for raising external investment and enabling growth. It is fundamental that the spin-out is set up correctly, together with any necessary governance agreements. It is important that you take your own independent legal as well as tax advice before incorporating a Company.

4.1 Incorporation

There are different types of Company that can be incorporated in the UK. Most startups will typically be a private company limited by shares. That way the shareholders will have limited liability, and they can also raise investment by selling shares. The Founders would undertake the process of incorporating the spin-out Company without the involvement of the University. Comprehensive guidance on Company formation is available at the Government website.

The foundational structure of the Company is defined by two key documents: the Memorandum of Association and the Articles of Association. These documents establish the Company’s legal existence and outline its internal rules and operations.

- Memorandum of Association – gives the Company its legal standing. The document confirms that subscribers wish to form a Company under the Companies Act and agree to become its first members. It provides core information about the Company, including its name, registered address, purpose, and extent of liability held by its members. It must be in a prescribed form, must be authenticated and signed by each member.

- Articles of Association (Articles) define the Company’s fundamental management and administrative framework. They govern the Company’s internal operations, covering matters such as the issuance and transfer of shares, meetings of the board and shareholders, the responsibilities and authority of directors, distribution of dividends, borrowing powers, and more. The Articles form a contractual relationship between the Company and each of its shareholders in their role as shareholders. While Companies have flexibility in drafting their Articles, they must comply with the applicable requirements of the Companies Act.

These documents must be delivered to Companies House together with an application for registration of the Company. Once registered both documents become public and are open to inspection at Companies House. The shareholders may also enter into a shareholders agreement which is private and not publicly available. It complements the Articles in relation to the running, governance and ownership of the Company. The shareholders’ agreement will also be an essential document and will be discussed in detail in Playbook for Spin-out with Investment.

4.2 Initial capital and Director’s duties

Every limited Company must have at least one director. You will also need to decide how many shares to issue and at what percentage to each shareholder. Shareholders and Directors have different roles and responsibilities within the Company.

The initial share capital. The planning work (Section 3) such as creating a business plan, concluding who is going to play a major role in the Company’s future and the investor pitch deck materials will have established the planned percentage ownership for each Founder in the Cap table. It is recommended that a nominal value of shares of no more than £0.001 is used for individual shares issued to Founders. There is no requirement to issue a specific number of shares but to avoid unnecessary sub-division or new issues, having enough to distribute with whole numbers for the Founding team, planned share options pool and University equity is advised. Then, at this stage, the number of shares (from Cap Table) can be allocated to each of the Founders (and any Contributors). Note that each subscriber (shareholder) will need to purchase their shares at this initial nominal level – this can be held on trust by the shareholder until the Company has a bank account. At the appropriate stage, it’s important that each shareholder does subscribe and pay for these shares as ‘fully paid-up’ shares absolutely convey certain rights.

Director’s duties. Under UK law, a director is anyone who is responsible for managing Company’s affairs. Directorship comes with significant legal responsibilities. Directors are ultimately accountable for how the Company is run. There are specific Director’s Statutory Duties which are set out in the Companies Act 2006. Briefly these are:

- To act within their powers.

- To promote the success of the Company for the benefit of its members (shareholders) as a whole, having regard to a non-exhaustive list of factors.

- To exercise independent judgment.

- To exercise reasonable care, skill and diligence.

- To avoid conflicts of interest.

- Not to accept benefits from third parties.

- To declare certain interests they have in a proposed transaction or arrangement with the Company.

It is important to understand that these should be followed by law. Breaching them can lead to personal liability for loss, disqualification from acting as a director and other legal consequences. It is essential to integrate them in everyday decision making.

4.3 Ongoing duties after incorporation

After incorporation you will have certain ongoing legal duties, which will include but are not limited to:

- Complying with laws, such as Companies Act 2006, relevant employment laws, GDPR and other legislation.

- Filling Company annual accounts and confirmation statements with Companies House.

- Reporting any changes to the Company (directors, registered address, company structure).

- Paying tax, submitting annual tax returns to HMRC.

Outcomes:

- As per Section 3 outcomes; plus

- A private limited incorporation Company suitable for the spin-out vehicle.

Section 5 - Finalising All Preparation Stages and Achieving Spin-out Completion

If all previous stages have progressed smoothly, then you should have a validated spin-out value proposition with commercial viability. The remaining challenge will be ensuring that the spin-out can be launched on an economically sustainable basis. All parties want to be confident of sufficient funding to support future development that satisfy a series of important milestones for Company growth.

For organic growth Companies contracts with customers provide funding potential while cashflow management needs to be capitalised and tightly managed. However, spin-outs are often at a pre-revenue stage and require additional external investment - involving the need for investor engagement and some additional documents / agreements.

Pre-conditions:

- Stage 4 outcomes; plus

- Spin-out Heads of Terms may or may not be finalised at this point;

- Significant progress towards reaching an early investor “in principle” agreement to provide funding.

5.1 Post- Incorporation / Pre- Spin-out (& licensing) stage

Before the IP is licensed to the spin-out. The Company may not operate by using, developing, manufacturing, selling or promoting any product dependent on the IP. However, it can apply for funding, convertible loans or grants on the basis that there is an intention to licence the IP, according to the Licence Heads of Terms (agreement with the University).

Legal advice should be taken prior to executing any convertible loans (a loan which can later be converted to equity) or an initial subscription agreement for initial funding to shares (e.g. a friends and family round). There is no requirement to have initial funding (of any kind) at this stage and the usual procedure would be to only dilute the shareholding structure through investment after completion of the transaction with the University.

University support to spin-outs during or post-incorporation: may provide various types of financial support to help them transition from research-based projects to commercially viable enterprises. Examples include - proof of concept and scaling funds, royalty or equity-based financing, access to innovation and growth programs and facilities and infrastructure support.

Grant funding: e.g. from Innovate UK, can play a crucial role in sustaining the initial development of the spin-out as well as adding to the valuation of the Company at subsequent fund raises. However, working on a grant-funded project once awarded is likely to require that the IP licence to be in place.

Shares: If the Company was initially incorporated with a single director, or if a change in number of issued shares is required to allow for the University or investor shareholdings, this can be done now, prior to completion. However, tax advice should be taken to avoid negative tax implications for shareholders.

Any changes in shareholding should be reflected in the cap table and recorded at Companies House.

5.2 Involving Investors in the Spin-out

Raising capital will be an essential part of being able to deliver the Company’s vision. Convincing third parties to invest in your business is also a key checkpoint that validates the market opportunity and the ability of the team to execute the business plan. The Founders will have been working on the business plan and investor pitch deck, with the support of their TTO, alongside other business support advisers (which probably include accelerator/ incubator staff in many Universities).

Initial valuation is a critical component around investment attractiveness, both before (pre-money valuation) and after (post-money valuation) the investment is made. A University spin-out company at launch, is beginning with zero resources and established team or operations – but probably a high potential to create a good opportunity if the whole business plan vision can be realised.

Valuation of pre-revenue Companies: Founders need to be realistic in their expectations, even if they are entirely convinced of the significant future potential. The capitalisation table (see section 1 above) within the Business Plan is the Founders’ main tool for simulating and managing investment, shareholdings and related future shareholders’ dilution as forecast future investment rounds are projected. University TTOs will be able to provide some insight to similar deals that have taken place at their University.

Investment may be required at multiple stages throughout the life of the Company and generally, the first investment is simultaneous with the IP licence agreement being executed and University receiving its shareholding.

However, as the Company takes on more shareholders, the board will need to balance the interest of multiple parties and reach conclusions regarding new share issues and investors based on the agreed “Company bible” (which may itself be changed by agreement of the board to suit incoming shareholders but sets out the foundations for the business operations); in this sense, the first raise is the most straightforward, with the Founders having most control.

Due diligence: Whatever the stage of the investment, the investor will carry out analysis of the spinout and its records. This process generally requires that the Company provides the investor with access to all relevant information about the company in a securely accessed database known as the “Data Room”. See the checklist and playbook related to creating a managing a data room here.

Following successful discussions with an investor, the investor will make an offer in-principle, described in either the Heads of Terms or in the investor’s own term sheet (which is an investment offer principles document, very similar to “Heads of Terms (HoT)”).

As well as detailing the investment offered for equity, the Term Sheet will include terms required in the Shareholders’ or Subscription agreements and in the Articles of Association, which cover possible future eventualities such as key personnel leaving (good leaver / bad leaver terms) and future sale of the company (e.g. tag along and drag along rights). See the Spinout HOTs -investment playbook for more details.

Within Heads of Terms (Term Sheet) documents, some of the obligations (e.g. confidentiality and possibly exclusivity), will be made legally binding, while other parts will not be. There will also be a clause covering costs involved in negotiating the transaction, whilst the spinout needs to commit to negotiating in good faith, it should strongly avoid any obligation to pay any third-party costs as it is standard for all parties to bear their own costs.

Once the Term Sheet / Heads of Terms is agreed, the process can move onto 5.3 below.

A summary of key points for Founders in respect of potential investors

Key elements of spin-out investor negotiation

- Equity stake: The percentage of ownership the investor receives in exchange for their investment.

- Valuation: Determining the Company's worth, which directly impacts the equity stake.

- Board representation: Whether the investor gets a seat on the Company's board of directors.

- Exit strategy: How the investor will eventually recoup their investment (e.g., initial public offering, acquisition).

- Intellectual property (IP) rights: Ensuring the Company has the necessary IP rights to operate.

- Milestones and performance metrics: Setting goals and targets to measure the Company's progress.

Challenges involved in taking external investment

- Balancing interests: Both the Company and the investor have different priorities. The Company wants to maximize its growth potential, while the investor seeks a return on investment.

- Negotiating leverage: The relative bargaining power of each party depends on factors like the Company's technology, current value, market potential, and the availability of alternative funding sources.

- Legal and regulatory complexities: Navigating IP laws, securities regulations, and other legal frameworks.

- Building trust and long-term relationships: Establishing a collaborative and mutually beneficial relationship between the Company and the funder.

Third-party negotiation

A third party may be involved in the negotiation process to facilitate communication and help reach a mutually agreeable outcome. This could be a legal advisor or a business consultant, or some other agent.

Both parties (Investors and Founders) can increase their chances of reaching a successful agreement that supports the growth of the spin-out Company, and provides a satisfactory return on investment for that investor, by understanding the key elements, challenges, and considerations involved in spin-out investor negotiation.

Investor onboarding

The process of bringing new investors into the spin-out through due diligence, legal documentation, account setup, and ongoing communication.

Key steps include:

1. Initial Contact and Due Diligence:

• Investor expresses interest in the spin-out.

• Spin-out provides pitch deck and supporting documents outlining business model, market analysis, team details, and financial projections.

• Investor conducts due diligence, including reviewing legal documents, financial statements, market research, and customer feedback.

2. Legal Documentation and Investment Agreement:

• Negotiation and finalisation of investment terms, such as equity stake, valuation, voting rights, liquidation preferences, and protective provisions.

• Drafting and signing of legal documents including subscription agreements, shareholder agreements, and necessary disclosure schedules.

• File required forms with the relevant organisations to notify them of the new ownership structure and investment round e.g., Companies House.

3. Regulatory Checks:

• Investor verification and compliance with Financial Conduct Authority (FCA) regulations.

• “Know Your Customer” (KYC) to verify investor identity and source of funds.

• “Anti-Money Laundering” (AML) to ensure compliance with regulations.

• Accreditation - to confirm investor eligibility based on net worth and income levels.

4. Account Setup and Funding:

• Opening of investor accounts on the company's investor portal.

• Wire transfer of investment funds.

• Issuance of shares or other equity instruments.

5. Investor Regular Engagement:

• Regular updates on company progress and financial performance through investor reports and newsletters.

• Access to investor portals or platforms for managing their investments and viewing relevant documents.

6. Maintaining open communication with investors through regular meetings, investor calls, and updates on key developments.

• Addressing investor concerns and providing timely responses to inquiries.

Important factors to consider during investor onboarding:

- Transparency - provide clear, accurate information about financials, risks, and potential challenges.

- Efficiency - streamline legal and administrative processes.

- Compliance - adhere to all applicable regulatory requirements regarding investor verification and reporting.

- Communication - establish a clear and consistent communication strategy with investors.

5.3 Working Towards Spin-out (Deal) Completion

Heads of Terms: If Heads of Terms have not yet been finalised, then this should be a priority. All other remaining activity on working towards spinning-out will depend on what is included within the Heads of Terms.

Deal Readiness

Once Heads of Terms have been completed, then the Spin-Out Transaction Documents are ready for final negotiations where agreement on the final version of the relevant agreements will be made between parties. The checklist guidance provides a good description of what documentation is likely to be required. Note that every spin-out case will have some unique individual requirements for the full set of legal agreements required for that specific opportunity.

The Company should have engaged independent lawyers to provide its legal advice, University staff are acting on behalf of the University and cannot advise founders or the spin-out. With the Company and its advisers taking a coordinating role, all the parties involved need to agree who is leading on particular legal agreements and how the process for reviewing and commenting on various agreement draft versions will operate.

External legal advice is potentially very expensive for early stage Companies, so the parties working collaboratively, even though they are counter-parties looking after their own interests, will be required. A common practice is that Universities often circulate the first version of the licence agreement (and any other IP related documentation) and the spin-out’s advisers create the first drafts of the subscription agreement, shareholders’ agreement and the Articles of Association. Impact-IP has developed the Deal Readiness Toolkit, co-created with law firms and investors, that is suitable for use as starting point documentation for University spin-outs, but other templates can be used. Other (spin-out) cases may have organised drafting differently, there are different options available, and these can be agreed with the parties.

Once the final stage of legal negotiation commences, different agreements will be at various stages of negotiation. Work should be undertaken efficiently and responses actioned quickly to draft agreements that are circulated. In an ideal case, all documents will be "in agreed form" and circulated for signature at the same time. It is not unusual to have last minute negotiations and/or changes, and it is important to carefully consider the impact of these on the overall case and dependent documents.

As the Company works through the fine detail of its plan for realising its commercial strategy, including technical development of the IP, the original resource and budget requirements will become clearer and may increase. It is essential that the Company has confidence in this before pitching for investment. The University will also expect to see the latest version of the business plan prior to completion.

Completion

For a separate IP Licence agreement, this is simply the execution of the agreement which was created from the Heads of Terms agreement, negotiated to agreed form.

For the University and spin-out Company Term Sheet, reaching completion requires execution of a number of different documents, beginning with the University share application letter setting out the University’s subscription for shares. Money paid for subscriptions are paid into the Company’s bank account.

Where external investment is synchronised with completing the University spin-out activity, then subscription agreement, shareholders agreement, the IP licence agreement and adopting new Articles are co-ordinated around the same completion process.

Completing the Corporate Bible

A Term Sheet also specifies key terms for changes to (or establishing a new), shareholders agreement between all parties (including investors if subscribing for shares at the same time), and similarly changes to the Articles of Association.

University or investor shareholdings may include the right to appoint new directors who will need to be appointed by the board. New directors must then sign a consent to act.

In the same way as Founder shares were issued as certificates, University and investors will receive share certificates from the Company signed by two directors (or one director + witness) within two months of share allocation.

Recording changes to the company

The Company is responsible for recording the approval of transaction documents, allotment of shares and appointment of directors in the board minutes. The Company also needs to prepare shareholders resolutions which confirm the basis on which the shareholders empower the board to act, for example to adopt the new articles and to allot shares.

In the same way that Founder shareholdings and directorships were recorded at Companies House using the WebFiling portal, all the above changes will also need filing within 14 days (for Special resolutions, Written Shareholders Resolution and new share capital issues).

Other agreements

Use of any University resources ( e,g, facilities, spaces or equipment) will be subject to University specific guidelines but will often be charged for at the normal rate for any other external arm's length third party. Any Facilities Access or Laboratory Access agreement will usually also be signed at completion.

If IP is brought to the company by a Founder or employee that is not included in the University licence, then the spin-out should execute a separate confirmatory assignment with them.

In addition, contracts (Employment or Sub-contract, Service Contracts or Consultancy agreements) will need to be put in place with any Founder or Originators, or any other University staff working on Company business. It is also important to have these contracts in place to ensure any IP developed while a University staff member is contracted to work on Company business is owned by the spin-out.

If the spin-out has non-executive directors as advisors to the board then letters of appointment will need to be agreed.

As the Company is now in a position to operate and create liabilities and risks for directors, employees, it’s customers, partners and potentially the public, it is important that the Company takes out appropriate business insurance (including professional indemnity, public liability, employer’s liability, directors insurance and product liability insurances as appropriate to the specific business activity).

Section 6 - Post-Completion Activity (everything (and all timescales) that happens after Completion (Board) Meeting

Having incorporated and established the spin-out Company, the focus turns to operational and commercial activities, such as building the team, product development and making sales.

This will involve establishing further sets of standard agreements, such as non-disclosure agreements to allow confidential discussions with suppliers or customers, customer contracts covering terms and conditions of sales, and staff employment and incentive agreements.

Further investment may also be required at a later stage of the business. The process of pitching for new investment and on-boarding a new investor follows the principles set out in Section 5.2 above.

Invested and licensed (spin-out) company

Once deal completion has taken place, then some key steps or tasks may still be required to ensure all arrangements are meticulously finalised, such as:

Activity: Issue of relevant share certificates to new shareholders, update share register and Companies House filings.

Who is responsible: Company

Activity: If Founders are moving (full-time or part-time) into the spin-out, ensure University employment contracts are appropriately amended.

Who is responsible: Founder/ University line management/ HR

Activity: If any founders remain within the University, then formal Conflicts of Interest (COI) will be evaluated and a COI Management Plan put in place.

Who is responsible: TTO (lead advisory) – founder/ University line management

Contents

Section 1 - Spin-out Context and When Spin-out is Appropriate Section 2 - “Spin-out” v. ‘Licensing’ – Why and How Decision is Made? Section 3 - Spin-out Preparatory (or ‘Working-Up’) Phase Section 4 - Legal Incorporation of the Spin-out Section 5 - Finalising All Preparation Stages and Achieving Spin-out Completion Section 6 - Post-Completion Activity (everything (and all timescales) that happens after Completion (Board) MeetingResources

Explore our ‘how-to’ guides and legal agreement resources to streamline spin-out company formation, help find investment and optimise licensing transactions.

PLAYBOOKS

How to guides explaining the ‘why’ and the ‘how’ of the commercial deal, ensuring an efficient process.

View PlaybooksTEMPLATES

A suite of lawyer-reviewed, legal Templates for everyone in the commercial deal to use.

View TemplatesCHECKLISTS

Useful Checklists to ensure that all critical elements are considered in the commercial deal.

View Checklist